Although managing and understanding the US Treasury’s Coronavirus Relief Funds (CRF) has been top of mind for many Tribes, there are several additional grant-policy amendments it’s important to be aware of. These changes impact the presentation of many Tribes’ Schedules of Expenditures of Federal Awards (SEFA), procurement, and other grants-management areas.

Below, we cover key policy changes, compliance requirements, and implications for your Tribal government.

OMB 2020 Compliance Supplement

On August 18, 2020, the Office of Management and Budget (OMB) released the updated 2020 OMB Compliance Supplement.

This supplement is effective for audits of fiscal years beginning after June 30, 2019. It continues the OMB mandate adopted in the 2019 Compliance Supplement that required each federal agency generally to limit the number of compliance requirements subject to audit to six.

The 2020 supplement doesn’t change this requirement, but it does indicate that auditors may need to audit additional areas for programs that incurred significant changes as a result of COVID-19.

The OMB also indicated it will be issuing an addendum to the Compliance Supplement in fall 2020, which will address the following changes:

- New federal programs established by the Coronavirus Aid, Relief, and Economic Security (CARES) Act

- Several existing programs impacted by COVID-19

COVID-19-Related Awards

The 2020 OMB Compliance Supplement covers key requirements connected to COVID-19-related awards.

Federal Agencies

Federal agencies are required to identify COVID-19 awards, regardless of whether funding is provided under a new or existing Catalogue of Federal Domestic Assistance (CFDA) number—now known as Assistance Listing.

Subaward Recipients

When COVID-19 funds are subawarded from an existing program, the information furnished to subrecipients should distinguish subawards of incremental COVID-19 funds from non-COVID-19 subawards under the existing program.

Pass-Through Entities

Pass-through entities must separately identify each subrecipient and document the following at the time of subaward and disbursement of funds:

- Federal award number

- CFDA number

- Amount of COVID-19 funds

SEFA and Form SF-FAC Reporting Requirements

This guidance requires that Tribes separately identify COVID-19 expenditures on the SEFA and in the data collection form (Form SF-SAC). This includes:

- Any new COVID-19 programs

- Programs where additional COVID-19-related funding was added to an existing award

Tribes can identify these expenditures in the following ways.

SEFA

Identify COVID-19 funds on a separate line by CFDA number with COVID-19 as a prefix to the program name. For example:

- COVID-19 Temporary Assistance for Needy Families—93.558 - $1,000,000

- Temporary Assistance for Needy Families—93.558 - $3,000,000

- Total Temporary Assistance for Needy Families—93.558 - $4,000,000

Form SF-SAC

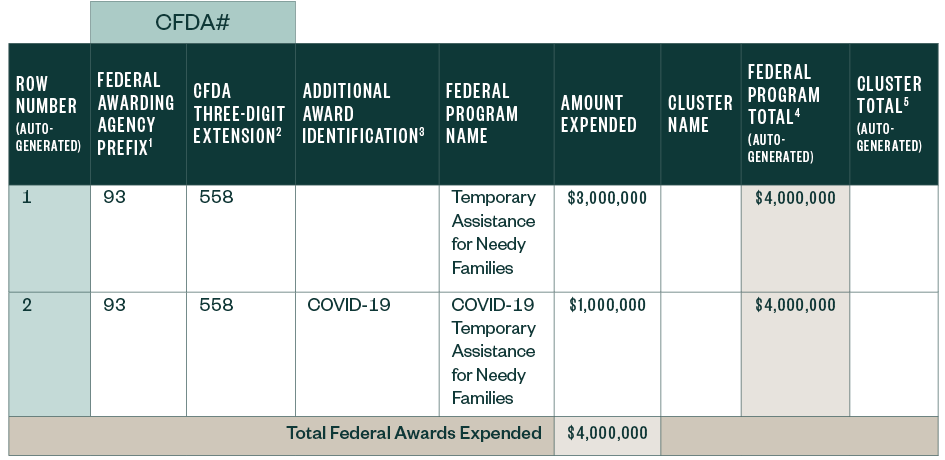

Report COVID-19 funds on a separate row by CFDA number with COVID-19 as the first characters in Part II, Item 1c, Additional Award Information. For example:

The federal government has also created a list of COVID-19 programs to help Tribes identify COVID-19 funds they may have received.

OMB Uniform Guidance Revisions

On August 13, 2020, the OMB published revisions to the Uniform Guidance—2 Code of Federal Regulations (CFR) Section 200—that are generally effective as of November 12, 2020, except as noted below.

It’s believed the effective date is intended to cover awards issued after November 12, 2020, but additional clarification is needed. Additionally, the effective date may be different for certain agencies that have implemented their own regulations. For these agencies, the effective date may be dependent on the issuance of revised agency regulations.

New Guidance

Proposed changes to the guidance were part of a normal review process that resulted in several changes, but the majority of the previous guidance remained unchanged. However, changes were made to several existing areas and new areas were added.

Never Contract with the Enemy

This new section clarifies federal awards over $50,000 are subject to the requirements of 2 CFR Part 183. However, the nature of these provisions are unlikely to impact Tribes unless they’re contracting or performing work outside of the United States.

Telecommunication and Video Surveillance

This new section prohibits expending grant funds from contracting—including extensions or renewals of existing contracts—for telecommunications equipment, services, or systems produced or provided by certain corporations and affiliates. The guidance was effective upon issuance on August 13, 2020.

To stay compliant with this change, work with your Tribe’s procurement department to flag the list of corporations and affiliates in your system. When you’re contracting for telecommunications or surveillance services or equipment, you should review these guidelines and incorporate any appropriate restrictions in your related-procurement solicitations and contracts.

Revisions to Existing Guidance

Performance Measurement

Language has been amended throughout the guidance to emphasize agency focus on substantive program accomplishments and consideration of data relating to programmatic effectiveness.

Tribes should expect to see new language added to grant-awards terms and conditions and additional requirements to establish, report, and measure performance to show achievement of program goals and objectives.

Where appropriate, this may include adopting specific program goals, indicators, targets, baseline data, data collection, expected outcomes, and timelines for accomplishment.

Budget Period

Additional guidance adds language around budget periods in addition to the existing guidance around period of performance. This guidance indicates that, for a cost to be allowable, it must be incurred not just within the period of performance from the grant, but also within the appropriate budget period.

Any requests to carryforward unobligated balances from one budget period to another must be approved by the agency, unless the agency has previously waived the requirement for written approval.

Procurement and Micropurchase Thresholds

As indicated in our previous Alert, the US Federal Government previously increased the Federal Acquisition Regulations’ (FAR) micropurchase threshold for all entities to $10,000 and the simplified acquisition threshold to $250,000.

The revised guidance incorporates those increases and allows for some additional changes:

- Determining micropurchase thresholds. Clarifies that entities are responsible for determining and documenting micropurchase thresholds based on internal controls, an evaluation of risk, and documented procurement procedures.

- Increasing micropurchase thresholds. Allows increases of the micropurchase thresholds for up to $50,000 if entities certify the following on an annual basis:

- They qualify as a low-risk auditee.

- They’ve performed an annual internal risk assessment to identify, mitigate, and manage financial risks.

- Their increase is consistent with state Tribal law.

- Approving micropurchase thresholds. Tribal thresholds higher than $50,000 must be approved by the cognizant agency for indirect costs.

Domestic Preferences for Procurements

A new section was added to the procurement guidance that indicates Tribes should, to the greatest extent practicable, provide a preference for the purchase; acquisition; or use of goods, products, or material produced in the United States and must include this requirement in all contracts and purchase orders.

Closeout Procedures

The revised guidance extends the timeline to liquidate obligations under an award up to 120 days after the date of the period of performance. Previously, only 90 days were allowed.

Similarly, the requirement to submit final financial and performance closeout reports has also been extended to 120 days for direct federal awards. It also clarifies that closeout reports between a pass-through entity and a subrecipient should be completed within 90 days.

Indirect Cost Rates

The guidance increases flexibility for using the 10% de minimis indirect cost rate. However, this new flexibility isn’t applicable to Tribes. Additionally, the guidance imposes new requirements for most entities to make federally negotiated indirect cost rate agreements publicly available, but Tribes are specifically exempt from this requirement.

Additional Grant Guidance

If your Tribe was utilizing grant-relief guidance OMB issued to federal agencies over the past year, it’s important to note the guidance issued in OMB Memo-20-26 expired on September 30, 2020, and the guidance issued in OMB Memo 20-17 expired on June 16, 2020.

We’re Here to Help

To learn more about guidance changes and potential implications for your Tribe, contact your Moss Adams professional.